How AI turned PDFs into decisions for a leading UAE bank

From hours of manual data entry to instant extraction: how an AI driven proof of concept reshaped credit assessments for a leading UAE bank.

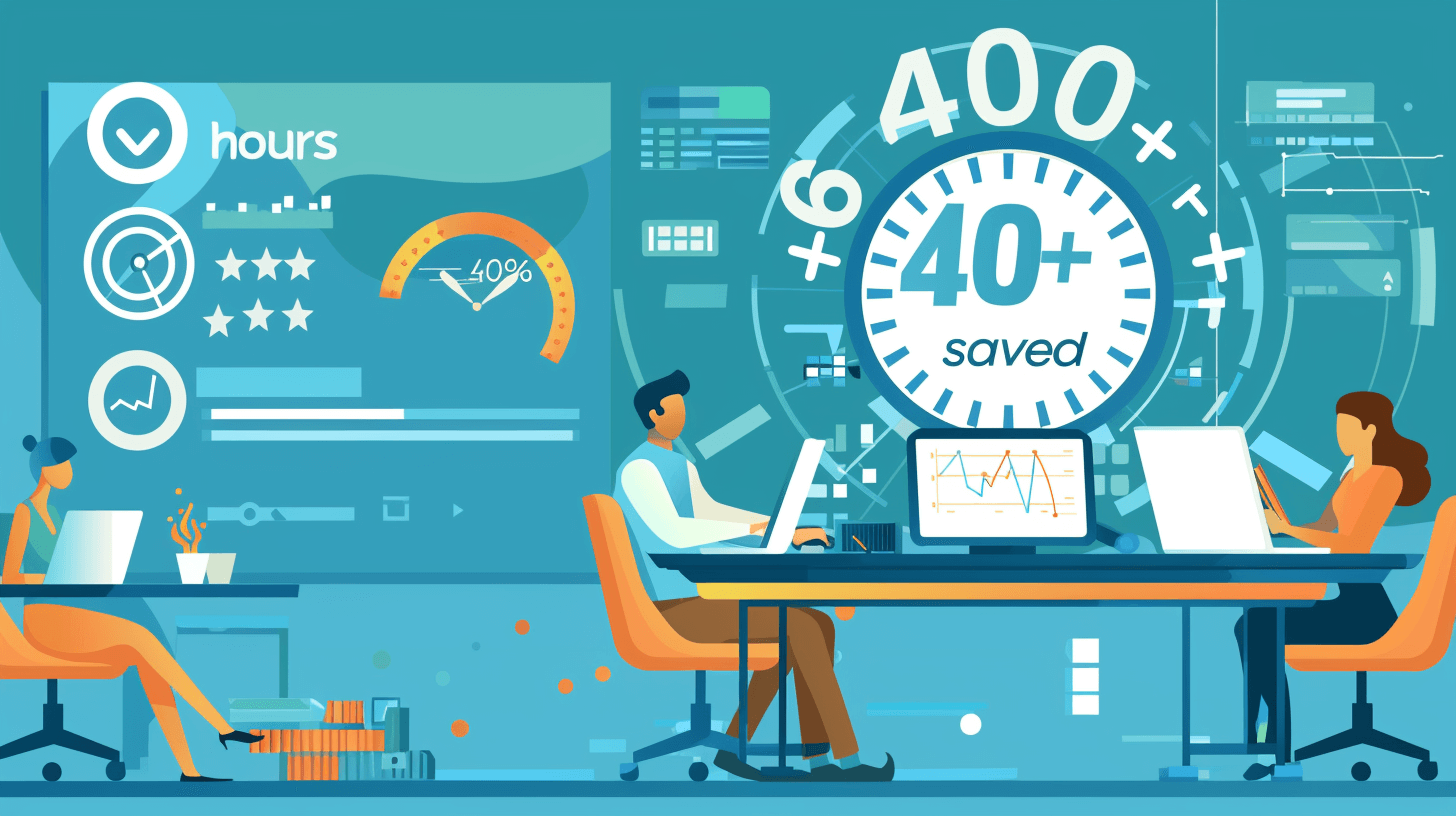

Results at a Glance

- AI prototype delivered for financial report data extraction

- Projected savings of 400 analyst hours per quarter

- Faster, more accurate credit assessments

- Validated path to full-scale production rollout

Introduction

Credit decisions move at the speed of data. But for one UAE bank, data was slowing them down.

A full-service multinational bank in the UAE relied on analysts to manually extract information from complex PDF financial reports. The process consumed hundreds of hours every quarter, introduced opportunities for error, and created delays in credit assessments. The bank needed a faster, more reliable way to process reports while freeing up its analysts for higher value work.

The challenge

Analysts were buried in PDFs, slowing down critical lending decisions.

Every quarter, the credit team was dedicating significant time to combing through financial reports, pulling out required data points by hand. The inefficiency created a bottleneck in the lending process and made the workflow vulnerable to mistakes. The bank’s leadership wanted an automated solution that could reduce the workload while improving accuracy and speed.

The solution

An AI powered prototype that turns static PDFs into usable data.

MISSION+ deployed a proof of concept project to test whether AI Language Models could automate the data extraction process. Within weeks, a working prototype was built. Analysts could upload PDF financial reports and receive structured data back, instantly. The POC validated both technical feasibility and compliance with privacy requirements, showing the bank that AI could transform its credit operations.

Impact

Hundreds of hours saved each quarter, with a clear path to scale.

The AI prototype delivered measurable results. Analysts are projected to save approximately 400 hours per quarter, accelerating credit assessments and reducing manual errors. The success of the POC confirmed readiness for a full-scale production rollout, positioning the bank to significantly enhance operational efficiency.

It all began with brainstorming sessions for a new name, which took time to get right

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript